肥料

肥料,对于农业生产部门是至关重要的,是印度经济的支柱。化肥可以分为化学肥料和有机肥料,在印度,化学肥料的使用更加突出。这些肥料的使用在印度农业生产中都扮演了非常重要的角色,起到了极大的作用,直接影响印度农业的丰收与否,不仅满足粮食的需求总量,而且还创建一个出口顺差。

印度化学肥料的使用直接关乎印度绿色革命的成功,对印度绿色革命的成功起到了至关重要的作用,随之影响和改变了自力更生的食品生产链,进而推动了这个行业的发展。目前印度是世界上第三大化肥生产商。化肥行业也是印度最重要的能源密集型行业,除了铝、水泥、钢铁、玻璃和纸产业之外,化肥产业已然成为印度的支柱产业,因为它需要各种燃料如天然气、燃油和石脑油作为原料进行生产。

Fertiliser

Fertiliser, a crucial input to the agricultural sector, forms the backbone of the Indian economy. Fertilisers can be classified into chemical fertilisers and organic fertilizers, of which chemical fertilisers are more prominently used in India. These have played a significant role in India’s agricultural success story, by not only fulfilling the total food grains requirements, but also creating an exportable surplus.

Chemical fertilisers played a crucial role in the success of India's green revolution and consequent self-reliance in food-grain production, which in turn gave an impetus to the growth of this sector. Presently India is the third largest producer of fertiliser in the world. The fertiliser industry is also one of the most energy intensive sectors within the Indian economy apart from aluminum, cement, iron & steel, glass and paper, as it requires various fuels like natural gas, fuel oil and naphtha, as raw materials for production.

Industry Size and structure

The Indian Fertiliser Industry, under the purview of the Ministry of Chemicals & Fertilisers can be segmented on the basis of the various nutrients.

Union Ministry of Chemicals and Fertilisers (Department of Fertilisers)

Structure of the Indian Fertiliser Industry

Potash (K) (Mainly imported)

Phosphate (P)

Public

Private

Co-operatives

Nitrogen (N)

Public

Private

Co-operatives

According to the data released by the Department of Fertilisers, the total installed capacity of the Nitrogen segment in India stands at 12.06 mn MT (million metric tonnes), of which, the public sector accounts for 29%, while private and co-operative sectors account for 26.27% and 44.73%, respectively.

The capacity in the phosphate segment is 5.7 mn MT with the share of public sector being 7.65%, while that of private sector is 30.27% and co-operatives accounts for 62.08%. There being no viable resources or reserves of potash in the country, the entire requirement is entirely imported. In addition to these segments, there are the complex fertilisers produced by combining various nutrients such as nitrogen, phosphate and potash in different proportions.

While urea, ammonium sulphate, calcium ammonium nitrate (CAN) and ammonium chloride are the nitrogenous fertilisers produced in the country; the only phosphatic fertiliser being produced is SSP (single superphosphate). Production of complex fertilisers include DAP (Diammonium Phosphate), several grades of nitrophosphates and NPK complexes. Of these, urea and DAP are the main fertilisers produced indigenously.

Demand & Supply – side factors

Fertiliser consumption mainly depends on various agriculture related factors such as soil quality, farming methods, rainfall and irrigation patterns, different geographical aspects, calamities, availability of technology and information, varieties and qualities of seeds as well as access to capital and credit and other inputs. With a shift in agricultural production from the traditional system of farming to intensive cultivation, fertiliser demand got a boost.

Moreover, macro-oriented factors such as crop related market forces, cropping pattern and fertiliser pricing policies too influence fertiliser consumption. Further, the Government has also taken various steps to spread the awareness about the benefits of fertilisers and ensure efficient usage of fertilisers, through the promotion of soil testing laboratories throughout the country.

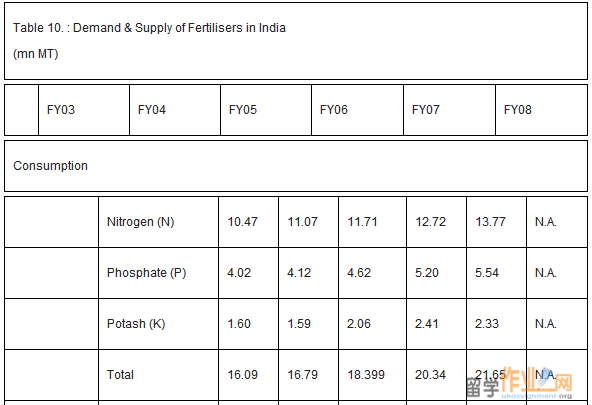

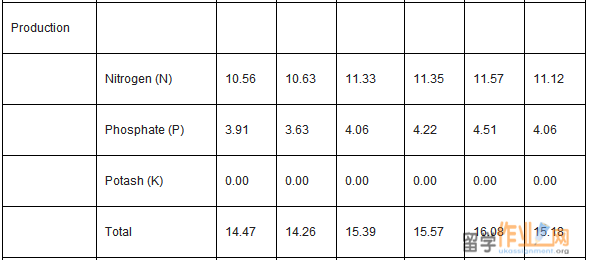

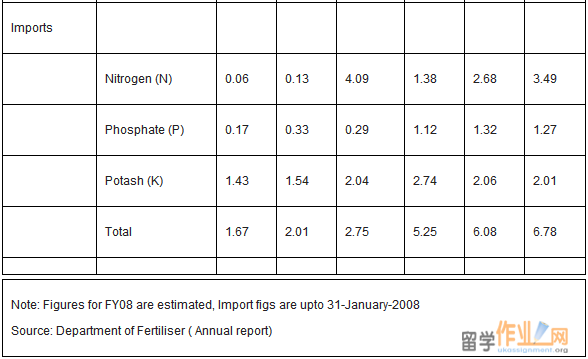

Consequently, the annual consumption of fertilisers in nutrient terms (N, P & K) increased from 0.07 mn MT in 1951-52 to 21.6 mn MT in 2006-07, with the per hectare consumption, which was less than 1 kg in 1951-52 increasing to 13.26 kg (estimated) in 2006-07. Urea and DAP are the most popular fertilisers, accounting for a major portion of the total fertiliser consumed in the country. Consumption of Urea, DAP and MOP (Muriate of potash) has been increasing continuously during the last few years, and in 2006-07 the consumption level stood at 24.48 mn MT, 6.92 mn MT and 2.40 mn MT, respectively.

Further, as per the projections of the Department of Agriculture & Cooperation (DAC), the demand during the Kharif season in FY072007 was for 13.16 mn MT of urea, 4.0 mn MT of DAP and 1.65 mn MT of MOP. This demand was met fully and sales of 12.45 mn MT of Urea, 3.61 mn MT of DAP and 1.41 mn MT of MOP were registered. Similarly, duirng the Rabi season of FY08, the demand was for 14.0 mn MT of Urea, 4.91 mn MT of DAP and 1.96 mn MT of MOP.

On the supply front, as per statistics provided by the Department of Fertilisers, at present there are around 64 large size fertiliser units in the country, manufacturing a wide range of nitrogenous and phosphatic/complex fertilisers. Of these, 39 units produce urea, 18 units produce DAP and complex fertilisers, 7 units produce low analysis straight nitrogenous fertilisers. Further, from these, 9 units produce ammonium sulphate as a by-product.

Besides, there are about 79 small and medium scale units producing single superphosphate (SSP). With an installed capacity of 12.06 mn MT of nitrogen and 5.65 mn MT of Phosphate the domestic fertiliser industry has more or less attained the levels of capacity utilisation comparable internationally. The capacity utilisation during 2006-07 was 96.0% for nitrogen and 79.8% for phosphate. The estimated capacity utilisation for 2007-08 was 92.2% of nitrogen and 71.9% of phosphate. Within this, the capacity utilisation in terms of the urea plants was 103.1% in 2006-07 and was estimated to be 101.1% in 2007-08.

Moreover, domestic raw materials are available only for nitrogenous fertilisers. For the production of urea and other ammonia based fertilisers, methane constitutes major input and is obtained from natural gas/associated gas, naphtha, fuel oil, low sulfur heavy stock (LSHS) and coal. In the recent years, production has increasingly switched over to the use of natural gas, associated gas and naphtha as feedstock or raw materials as these are more efficient and less polluting than other heavy fuels like fuel oil and coal.

Of these, gas is in fair abundance within the country. The raw materials for the production of phosphatic fertiliser have to be imported as India has no source of elemental sulfur, phosphoric acid and rock phosphate. As for Potash (K), since there are no viable sources/reserves in the country, its entire requirement is met through imports.

Exports as well as dispatch of urea is prohibited without Government’s permission under the Fertilisers Movement Control Order (1973). Hence, the dispatches of urea to State and Union Territories (UT) from manufacturers are arranged through a monthly dispatch plan by the Department of Fertilisers under the Ministry of Chemical and Fertilisers.

The Government in consultation with the State Governments/UT assesses the requirement of urea for each state and UT prior to each crop season. Initially the demand is fulfilled through allocations from indigenous production. However, in case of a gap between the demand and the indigenous supply the demand is met through imported urea.

The production fertilisers stood at 11.57 mn MT for nitrogenous fertilisers and 4.51 mn MT for phosphatic fertilisers in FY07. This witnessed a to 11.12 mn MT for nitrogenous fertilisers and 4.06 mn MT for phosphatic fertilisers in FY08. Rising price of crude oil, whose derivatives are used as a key input in fertilizer plants as well as that of other raw materials, coupled with capacity limitations and delay in payment of subsidies by the Government led to the shortfall in fertilizer production in 2007-08.

Table 10. :

Government Policies and Way forward:

Considering the vital role of fertilisers in making India self-reliant in terms of food security, the Government of India has been consistently pursuing policies conducive to increase the availability and usage of fertilisers in the country. In effect, the sector does feature Government control especially in terms of pricing and supply.

More importantly, the cost of fertilisers to farmers is subsidised, wherein the Government fixes a selling price and then compensates manufacturers for the difference between the cost of production and the selling prices. It is therefore interesting to briefly scan the some of the important Government policies concerning this sector and the implications and impact.

15012858052

15012858052

153688106

153688106